PricewaterhouseCoopers Report Promotes Bitcoin to Clients

PricewaterhouseCoopers (PwC) is the second largest network in “the Big Four” auditing firms, and is now the second to release a glowing report about Bitcoin to its clients.

Also read: Bitcoin Risk Assessment: Fears of Adopting Digital Currency

Deloitte, the largest network in the Big Four, has endorsed Bitcoin, or at least blockchain technology, several times, starting with a client report in November of 2014 that suggested for clients to pay their staff using Bitcoin.

After releasing a detailed whitepaper on the subject of creating a state-sponsored “Fedcoin” that governments could use to replace their national fiat currencies, Deloitte’s latest Bitcoin news is its formation of offshoot company Rubix, which is a service that build clients their own blockchains.

PwC, however, has released findings that suggest not only is Bitcoin here to stay, but its effects are unavoidable and will be disruptive to the existing financial system in a desirable way. In the 18-page PDF brief titled: “Money is no object: Understanding the evolving cryptocurrency market,” researcher Andrew Luca and his team do a thorough job explaining to the promise of the Blockchain to PwC clients and go as far as making some forecasts for who will be using it and when.

[Cryptocurrency has] “gained acceptance from a critical mass of investors, technologists, regulators, merchants, entrepreneurs and consumers… In fact, in our view, cryptocurrency represents the beginning of a new phase of technology-driven markets that have the potential to disrupt conventional market strategies, longstanding business practices, and established regulatory perspectives – all to the benefit of consumers and broader macroeconomic efficiency.” -PwC

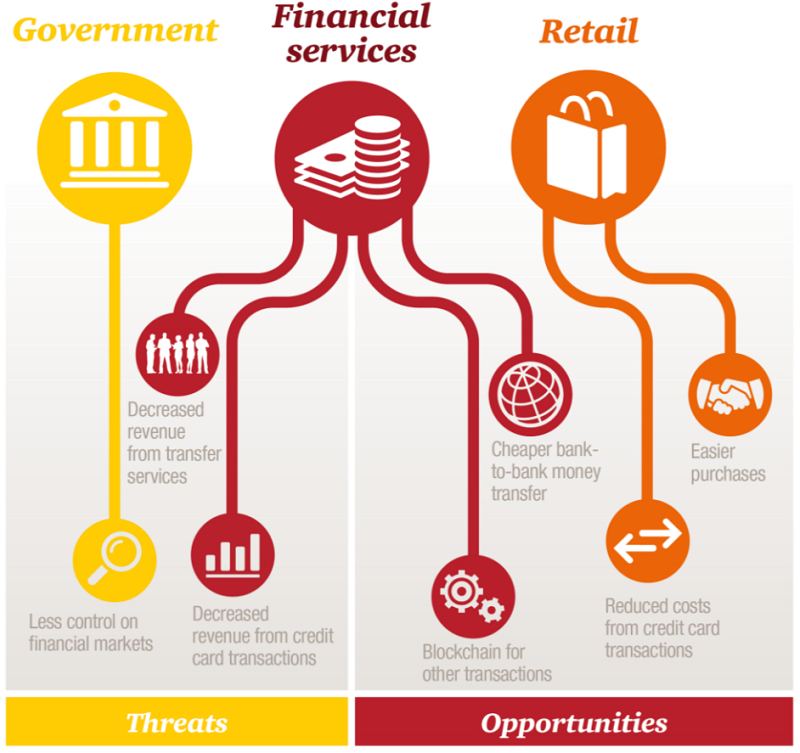

The report attempts to map out the potential impact of all cryptocurrencies, both in terms of disruption and opportunity, across the tech, investment, and financial sectors. Throughout the report, PwC acknowledges the diminishing role of middlemen due to the resulting reduction of the banking sector, stating that “what sets cryptocurrency apart from other recent payment innovations is its potential to dramatically limit the role of traditional financial institutions in clearing and settling payments.”

As we often see from within the greater finance industry, the report makes a clear separation between the currency and the blockchain. They make the argument that money, in general, is “the most regulated thing in the world,” and so “for that reason, cryptocurrency will not reach its true market potential unless and until it develops in harmony with applicable regulations.”

Even still, it is more bullish on Bitcoin than Deloitte’s report, which stopped short of suggesting the currency had any future.

“The reporting of the results of a client poll they have conducted were especially bullish. “86% of respondents who have used cryptocurrencies in the last year expect their use of cryptocurrencies to significantly increase in the next three years.” -2015 PwC Consumer Cryptocurrency Survey.

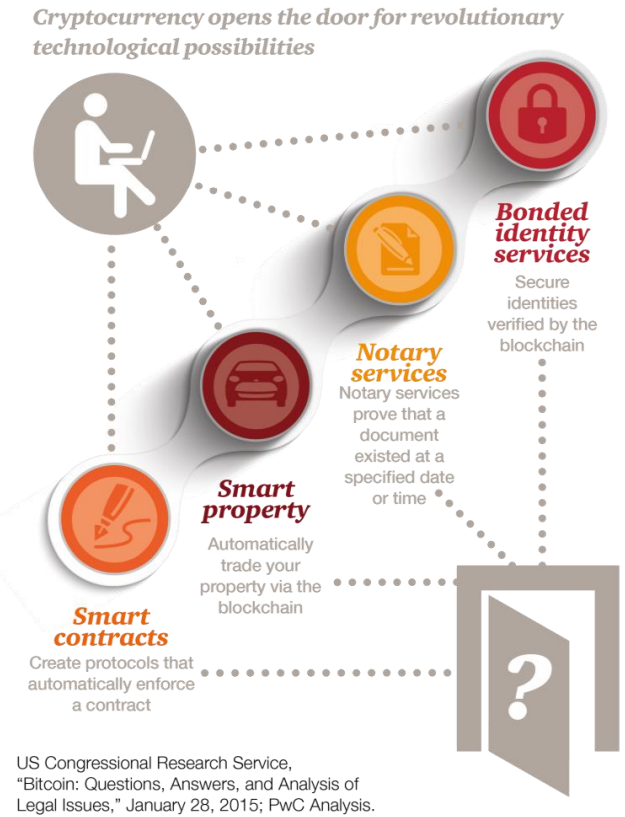

At one point, it even seemed to be able to detect that the two were impossible to separate. “The combination of blockchain technology and cryptocurrency has the potential to open the door to other revolutionary possibilities.”

The report went on to feature a detailed section on international laws and regulations, and even attempted to show the dividing line between which parts of bitcoin are a threat and which parts are opportunities.

Of course, many bitcoiners and economists would disagree on what makes a threat, such as the government having less control over financial markets. Even still, it is more positive than negative and covers a lot of area in a short amount of reading.

“As the regulatory landscape develops and the market matures, more traditional business strategies may begin to play a greater role in achieving success. However, as with most groundbreaking markets, the combination of ingenuity and speed to market is likely to distinguish the market leaders.” -PwC

Perhaps most interesting was its’ notice of emerging markets, and admission that legacy remittance services like Western Union will be upended.

“There is already strong evidence of this concept at work in the M-Pesa and M-Paisa systems that have developed in Kenya and India, respectively. Cryptocurrency will likely build on these innovations to offer the potential for micropayments and cheaper remittances across borders. If cryptocurrency is able to offer lower cost solutions for economically disadvantaged populations, this may be the technology’s greatest legacy.” -PwC

Together, Deloitte and PwC have over 400,000 employees that go to client sites around the world and spread this advice at the majority of the FTSE 100 and 250 indexes of large and mid-sized businesses. If corporate clients have any questions about cryptocurrency, these reports and their authors will likely be their first point of contact.

Do you think major finance firms will adopt Bitcoin any time soon? Let us know in the comments below!

Image credit: PricewaterhouseCooper